Partnering for Satisfaction

Policyholder satisfaction is built one interaction at a time. Aspen Claims Service uses its Claims Plus Approach to help carriers deliver exceptional experiences—combining speed, professionalism, and proactive communication in every claim.

February 28

Aspen Claims

Minimizing Disputes Before They Begin

Disputes don’t have to be part of the claims process. With clear expectations, solid documentation, and a little proactive communication, adjusters can head off conflict before it starts—keeping claims on track and policyholders at ease.

February 27

Claims Pages Staff

How to Maximize the Bicycle Accident Claim

Bicycle accidents can result in severe injuries, emotional trauma, and financial burdens. If you’ve been involved in an accident caused by another party’s negligence, pursuing a compensation claim is essential.

February 27

Sponsored

Personalizing the Claims Experience

Every claim is unique—because every policyholder is. Tailoring communication, tone, and process to meet individual preferences can reduce confusion, build trust, and turn a stressful situation into a positive experience. Small personal touches make a big impact.

February 26

Claims Pages Staff

Speed Without Sacrifice Making Claims Efficient and Fair

Fast resolutions matter, but thoroughness and fairness can’t be overlooked. Smarter automation, process refinements, and strategic decision-making keep claims moving quickly without cutting corners or increasing errors.

February 25

Claims Pages Staff

Building Trust Through Clear Communication

Miscommunication can turn even the simplest claim into a frustrating ordeal. Keeping policyholders informed, setting expectations early, and using plain language ensures smoother interactions. Mastering these techniques helps create transparency and confidence in the process.

February 25

Claims Pages Staff

Why Do Insurance Companies Sell Cars at Auctions? The Business Behind Total Loss Vehicles

An insurance company has a sizable say in the fate of any car once it has been damaged in a crash, flood, or natural disaster. While many cars get repaired and handed back to the owner, a great number get determined a total loss and auctioned off.

February 25

Sponsored

Teachable Pricing Plans and Features Explained Before You Sign U

Exploring the realm of online learning platforms can feel overwhelming at times due to the abundance of choices! Selecting the one demands deliberation and weighing various factors in play.

February 25

Sponsored

Fun Weekend Activities You Can Enjoy from the Comfort of Your Home

The weekend is finally here, and you're stuck at home — so what do you do? Well, staying indoors doesn't have to mean being bored!

February 12

Sponsored

Emerging Trends in Digital Health Management: Transforming Healthcare with Innovation

Digital health management is transforming how we approach wellness, making healthcare more accessible and personalized than ever. With advancements in technology, we’re seeing groundbreaking tools and platforms that empower us to take control of our health.

February 10

Sponsored

The Power of Data Integration Across Claims Systems

Disconnected data leads to inefficiencies and missed opportunities. Examine how integrating claims data across platforms creates a more seamless, accurate, and responsive process—empowering adjusters with the full picture to make better decisions.

January 31

Claims Pages Staff

Real Time Reporting Driving Faster Claims Resolutions

In a world where speed matters, real-time data is revolutionizing claims processing. This article breaks down how adjusters can use live reporting tools to accelerate investigations, enhance communication, and improve claim turnaround times.

January 31

Claims Pages Staff

Uncovering Fraud Before It Happens With Data Science

Fraudulent claims cost insurers billions each year, but analytics is turning the tide. Learn how machine learning and behavioral pattern recognition are helping adjusters detect red flags early, prevent losses, and strengthen fraud prevention efforts.

January 31

Claims Pages Staff

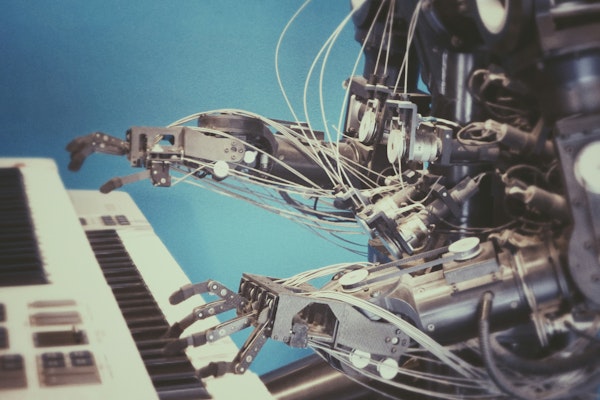

Automation Meets Intelligence in Claims Handling

The future of claims management isn’t just automation—it’s intelligent automation. Discover how advanced data analytics is powering claims systems that learn, adapt, and refine themselves, reducing manual effort while enhancing accuracy and service speed.

January 31

Claims Pages Staff

Predictive Analytics Reshaping Claims Processing

Data is no longer just a record-keeping tool—it’s the driving force behind faster, more accurate claims resolutions. This article explores how predictive analytics helps adjusters anticipate claim severity, detect fraud, and allocate resources efficiently, leading to smarter, proactive decision-making.

January 31

Claims Pages Staff