Hail Causes Over Half of Solar PV Weather Claims in North America According to AXIS Capital Report

Hail is the leading driver of solar PV natural catastrophe claims in North America, with AXIS Capital urging better forecasting and resilient system design to reduce losses.

July 12

Catastrophe

Property

Risk Management

Technology

Georgia Countertop Manufacturer Fined for Exposing Workers to Dangerous Silica Dust

OSHA cited Brazilian Stone Design LLC with seven serious violations after determining employees were exposed to unsafe levels of respirable crystalline silica on the job.

July 12

Legislation & Regulation

Property

Risk Management

Workers' Compensation

Georgia

New Report Ranks Safest and Riskiest U.S. Cities for Drivers in 2025

Allstate’s 2025 America’s Best Drivers Report reveals which U.S. cities saw the greatest improvements and setbacks in collision rates based on auto claims data.

July 10

Auto

Property

Risk Management

Technology

Reinsurance Market Turns Favorable for Buyers as Capital Surges in Midyear 2025 Renewals

Record reinsurer capital and strong insurer performance are driving lower rates and broader coverage in the 2025 midyear reinsurance renewals, Aon reports.

July 10

Catastrophe

Litigation

Property

California

Florida

Corporate Sustainability Strategies Gain Traction as Companies Eye Profitable Climate Resilience

Most companies now view sustainability as a value driver, with 88% recognizing profit potential despite high investment costs and climate-related operational challenges.

July 7

Insurance Industry

Property

Risk Management

Technology

Louisiana Supreme Court Ruling Strengthens Contractor Defense in Road Signage Dispute

A Louisiana Supreme Court decision clarifies summary judgment standards, strengthening contractor defenses and reducing litigation exposure for insurers in similar cases.

July 7

Insurance Industry

Legislation & Regulation

Litigation

Property

Louisiana

How to Manage Property Risk in 2025 with Smarter Valuation and Technology

As extreme weather events and insurance costs rise, property owners must adopt data-driven valuation, smart tech, and alternative coverage to remain insurable.

July 7

Catastrophe

Property

Risk Management

Technology

California

Florida

How Water Leak Sensors Are Transforming Insurance Economics

Bolt’s successful integration of IoT water sensors with homeowner policies significantly reduces water damage claims, reshaping insurance profitability.

July 2

Property

Risk Management

Technology

Underwriting

Swiss Re Identifies Rising Risks Including Declining Trust, Excess Mortality, and Digital Liability

Swiss Re’s 2025 SONAR report examines emerging structural risks including trust erosion, mortality fluctuations, and digital liabilities reshaping insurance claims and coverage.

July 2

Fraud

Liability

Life & Health

Property

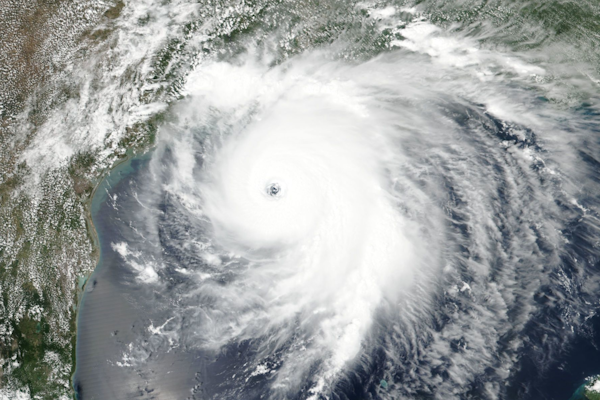

Loss of Military Satellite Data May Affect Hurricane Forecast Accuracy

Critical satellite data used for predicting rapid hurricane intensification will end June 30, potentially complicating forecasts during peak hurricane season.

June 30

Catastrophe

Property

Risk Management

Technology

How PFAS Influence Environmental Liability Risks in Construction Projects

Westfield Specialty’s Dennis Willette explores how PFAS contaminants shape environmental liability coverage in construction and why contractors need this insurance.

June 25

Legislation & Regulation

Liability

Property

Risk Management

Wildfires and Storms Drive Record Claim Severity in Early 2025 as Volume Hits Five-Year Low

Despite costly California wildfires and severe storms in Texas and the Midwest, property claim volume in Q1 2025 dropped to its lowest level in five years, Verisk reports.

June 24

Catastrophe

Insurance Industry

Property

Risk Management

Why Florida, Texas, and California Lead the Nation in Lightning Insurance Claims

Florida, Texas, and California consistently rank highest for lightning-related insurance claims due to storm frequency, surge damage, and wildfire-triggered losses.

June 24

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

Texas

Frustrating Digital Claims Processes Keep 20% of Consumers from Filing

A recent Insurity survey highlights the importance of blending digital convenience with human support to enhance policyholder satisfaction and claims experiences.

June 24

Auto

Insurance Industry

Property

Technology

Three Arrested in California Farmhouse Arson and $200K Insurance Fraud Scheme

Federal, state and local investigators allege three men—including a municipal vice mayor and a school board trustee—set a Northern California farmhouse ablaze and filed false insurance claims to net $200,000.

June 23

Fraud

Insurance Industry

Litigation

Property

California