Mulberri Launches AI Risk Engine to Revolutionize Workers’ Compensation Underwriting

Enhancing accuracy and profitability, Mulberri’s new AI Risk Engine promises to revolutionize workers’ compensation underwriting.

November 8, 2023

Risk Management

Technology

Underwriting

Workers' Compensation

Nike Launches Legal Battle Over Sneaker Tech Patents Against New Balance and Skechers

Footwear giant Nike filed federal lawsuits against New Balance and Skechers, accusing them of infringing patents related to Nike’s technology.

November 7, 2023

Litigation

Technology

Underwriting

California

Massachusetts

Oregon

Storm Losses Dent P&C Sector Profits, Optimism Brews for 2025 Revival

Severe convective storm losses—the highest in decades—significantly affected the 2023 net combined ratio for the property/casualty industry, according to the latest underwriting projections by Triple-I and Milliman actuaries.

November 2, 2023

Auto

Catastrophe

Legislation & Regulation

Property

Risk Management

HoneyQuote Partners with First Connect to Give Agents Access to the Florida Insurance Market

HoneyQuote, a digital insurance marketplace, has partnered with First Connect Insurance Services to grant thousands of independent agents nationwide the ability to seamlessly write policies in Florida.

October 23, 2023

Insurance Industry

Property

Technology

Underwriting

Florida

The Promise of Continuous Underwriting

Typically, a risk is underwritten, bound... and forgotten. But new streams of data and automation allow for continuous underwriting.

October 12, 2023

Technology

Underwriting

Traveling Down a Bumpy Road: Carrier Challenges and Opportunities

With rising inflation and interest rates, geopolitical tensions, climate change uncertainty, and growing competition, U.S. insurance carriers face several challenges to delivering consistent, high-quality insurance services and products to the marketplace.

October 3, 2023

Education & Training

Insurance Industry

Legislation & Regulation

Risk Management

Technology

How Proposition 103 Worsens Risk Crisis in California

California is not the only U.S. state struggling with insurance availability and affordability, but -- as described in a new Triple-I Issues Brief -- its problems are exacerbated by a three-decades-old legislative measure that severely constrains insurers’ ability to profitably insure property in the state.

September 25, 2023

Insurance Industry

Legislation & Regulation

Underwriting

California

What’s Trending in Auto Loss Combined Ratios

Some Canadian auto insurers may be experiencing fewer losses than their U.S. counterparts, a new report from ratings agency Fitch suggested.

August 21, 2023

Auto

Underwriting

Allstate to Pay $90M in Shareholder Settlement

Allstate (ALL.N) agreed to pay $90 million to settle a class action lawsuit by shareholders who accused the insurer of defrauding them by concealing that it lowered underwriting standards to boost growth.

August 18, 2023

Auto

Litigation

Underwriting

Predicting What Distribution, Underwriting and Claims Will Look Like in the 2030 Insurance Value Chain

In 2030, the world will look, feel and function in new ways. But how will the insurance value chain be affected by the new technology, ideas and regulations that will exist in seven years?

July 14, 2023

Insurance Industry

Technology

Underwriting

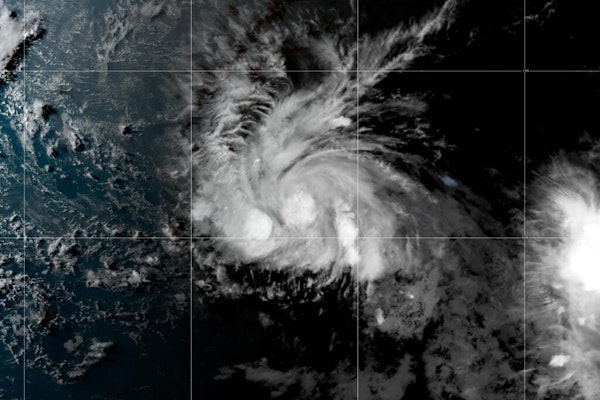

Predictive Model Anticipated Tropical Storm Bret’s Early Appearance

Tropical Storm Bret has formed in the central tropical Atlantic -- two months ahead of schedule for that part of the ocean. Fortunately, the technology and expertise were in place to anticipate this second named storm of the 2023 Atlantic hurricane season.

June 21, 2023

Risk Management

Technology

Underwriting

A Predict & Prevent Approach Works When Tech Innovation, Underwriting and Risk Management Work Together

Unlocking the full potential of Predict & Prevent strategies takes teamwork. We need insurers, tech innovators, policymakers, customers and others working together to create, test and launch solutions that stop losses in their tracks. It’s an exciting idea, but how do we make it happen?

May 30, 2023

Risk Management

Technology

Underwriting

3 Key Uses for Generative AI

To bolster innovation, insurers are turning to a technology that, in its short lifetime, has already created massive changes in business and the world. Generative AI, a type of artificial intelligence that can create content, rather than simply analyzing existing data, has been at the core of experiments in trying to optimize insurer processes, predict risk and develop customized policies for individual customers.

May 16, 2023

Fraud

Technology

Underwriting

US Insurers Report Bigger Underwriting Loss In 2022

The U.S private insurance industry saw a $26.9 billion net underwriting loss in 2022, more than six times the $3.8 billion loss in 2021 and the largest underwriting loss since 2011, according to preliminary estimates from Verisk Analytics Inc. and the American Property Casualty Insurance Association.

March 29, 2023

Underwriting

2017-22 Losses A ‘Wake-Up Call’ To Better Assess Climate Risk

The record global natural catastrophe losses between 2017-22 are a ‘wake-up call’ for the industry to ‘better assess, manage, and transfer’ the risks of future climate-related events, saids Mohsen Rahnama, CEO of Moody’s RMS.

March 16, 2023

Risk Management

Underwriting