Sea Level Rise by 2100 Could Displace Millions and Damage $1 Trillion in Property

A one-meter rise in sea levels by 2100 may expose over 14 million people and $1 trillion worth of property to flooding, erosion, and subsidence along the Southeast Atlantic coast.

November 22, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Virginia

Emerging Trends in Liability Claims Reshape U.S. Risk Landscape

Liability claims are surging due to nuclear verdicts, evolving litigation trends, and the influence of AI, according to Allianz Commercial’s latest report.

November 22, 2024

Liability

Litigation

Technology

Florida

Jacksonville Insurance Employees Arrested for $1.14M Fraud Scheme

Two Jacksonville healthcare employees allegedly submitted over 40 false claims, defrauding their employer of $1.14 million from 2019 to 2023. Both face serious charges.

November 18, 2024

Fraud

Insurance Industry

Legislation & Regulation

Risk Management

Florida

Navigating Flood Insurance Challenges After Hurricanes Helene and Milton

Hurricanes Helene and Milton highlight significant issues in the U.S. flood insurance market, showcasing the gaps in coverage, private market growth, and lessons from Florida’s response.

November 18, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Flood Insurance Gaps Highlighted by Hurricane Helene’s Impact

The devastation caused by Hurricane Helene sheds light on the widespread lack of flood insurance, revealing critical challenges in accessibility, affordability, and risk awareness.

November 18, 2024

Legislation & Regulation

Property

Risk Management

Florida

Louisiana

Texas

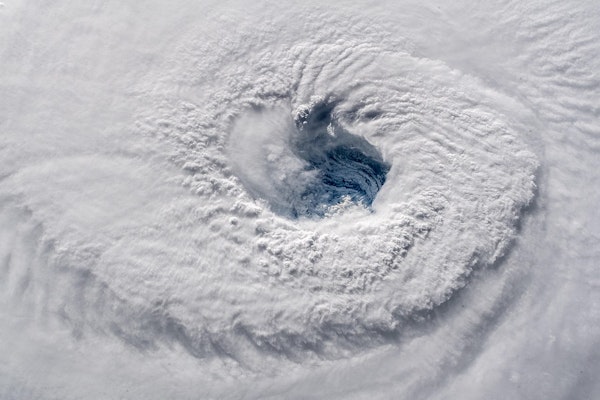

New Climate Research Reveals Worsening Global Conditions in 2024

As COP29 unfolds in a year of record-high temperatures, new research reveals accelerating climate effects, from supercharged storms and wildfire deaths to a slowing Atlantic current, raising concerns about a range of tipping points.

November 14, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

North Carolina

Rising Inland Flood Risk Demands Urgent Attention in U.S.

The Insurance Information Institute’s latest report highlights the increasing flood risks faced by inland areas due to shifting weather patterns. Hurricanes, tropical storms, and thunderstorms are pushing the boundaries of flood-prone regions, underscoring the need for better insurance coverage, flood resilience, and mitigation strategies to bridge the protection gap in non-coastal communities.

November 14, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Georgia

Kentucky

New Jersey

New York

Florida Hurricane Damage Claims Reach $4.775 Billion After Hurricanes Helene and Milton

Insurance claims in Florida from Hurricanes Helene and Milton have reached $4.775 billion, up $169 million from last week’s total. The storms have left extensive residential and commercial property damage, according to the Office of Insurance Regulation.

November 12, 2024

Catastrophe

Insurance Industry

Legislation & Regulation

Property

Florida

Georgia

North Carolina

South Carolina

Tennessee

Momentum Builds for Florida Insurance Law Board Certification

Support grows for a new Florida Bar board certification in "Insurance Coverage Law," aiming to help residents find specialized legal help for insurance disputes following major hurricane seasons.

November 7, 2024

Insurance Industry

Legislation & Regulation

Litigation

Property

Florida

Florida Communities’ Resilience Investments Prove Effective Against Hurricane Milton

As Hurricane Milton hit Florida, resilience-focused communities like Babcock Ranch and Hunters Point emerged unscathed, showcasing how disaster preparedness measures protect homes and reduce long-term costs, even amid costly initial investments.

November 7, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

California

Florida

Louisiana

Oklahoma

St. Petersburg Reduced Insurance Coverage for Tropicana Field Months Before Major Hurricane Damage

Ahead of the 2024 hurricane season, St. Petersburg reduced Tropicana Field’s wind and flood coverage from $100 million to $25 million, exposing the city to significant risk. After Hurricane Milton destroyed the stadium’s roof, officials now face uncertainties about potential coverage shortfalls.

November 5, 2024

Insurance Industry

Litigation

Property

Risk Management

Florida

2024 Hurricanes Leave Nearly 350,000 Cars Flood-Damaged, CARFAX Warns

In 2024, hurricanes have left an estimated 347,000 vehicles with flood damage across the U.S., CARFAX reports. Experts caution that many may be resold, potentially concealing dangerous and costly water damage.

November 5, 2024

Auto

Catastrophe

Fraud

Risk Management

Florida

How Attorney Ads May Drive Up Auto Insurance Rates, Per New Survey

A recent IRC survey reveals that attorney advertising may be influencing auto insurance costs, as 60% of respondents link it to higher claims and 52% believe it raises insurance premiums.

October 30, 2024

Auto

Insurance Industry

Legislation & Regulation

Litigation

Florida

Georgia

Louisiana

NFIP Flood Insurance Claims Surge to 54,000 After Hurricane Helene, FEMA Reports

Following Hurricane Helene’s landfall in Florida, over 54,000 NFIP flood insurance claims have been filed, with FEMA reporting $480 million in early claims payments. This storm, among the most significant for NFIP, may see more claims as impacted areas become accessible.

October 28, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Texas A&M Research Links Climate Change to Increased Hurricane Rainfall in the Southeast

A Texas A&M study shows a nearly 20% increase in extreme rainfall during storms like Hurricane Helene, linking climate change to intensified flooding risks across the southeastern United States.

October 28, 2024

Catastrophe

Property

Risk Management

Florida

Georgia

North Carolina

Texas