U.S. Wildfires and Storms Push Global Insured Catastrophe Losses to $100 Billion in First Half of 2025

Aon’s midyear catastrophe recap shows $100 billion in insured losses—second-highest ever—driven by U.S. wildfires, convective storms, and a costly earthquake in Myanmar.

July 17

Catastrophe

Insurance Industry

Property

Risk Management

California

Missouri

Reinsurance Market Turns Favorable for Buyers as Capital Surges in Midyear 2025 Renewals

Record reinsurer capital and strong insurer performance are driving lower rates and broader coverage in the 2025 midyear reinsurance renewals, Aon reports.

July 10

Catastrophe

Litigation

Property

California

Florida

Lululemon Sues Costco Over Lookalike Apparel Alleging Consumer Confusion

Lululemon claims Costco’s low-cost apparel mimics its trademarked designs, misleading customers and violating trade dress protections under U.S. trademark law.

July 7

Insurance Industry

Liability

Litigation

Risk Management

California

How to Manage Property Risk in 2025 with Smarter Valuation and Technology

As extreme weather events and insurance costs rise, property owners must adopt data-driven valuation, smart tech, and alternative coverage to remain insurable.

July 7

Catastrophe

Property

Risk Management

Technology

California

Florida

Cyber Risk and Technology Trends Reshaping Business Resilience in 2025

Executives’ cyber risk awareness is climbing, yet a misplaced confidence in cyber resilience persists amid escalating threats and geopolitical instability.

June 30

Legislation & Regulation

Liability

Risk Management

Technology

California

Auto Claims Profitability Improves Amid Rising Casualty Costs and Trade Issues

Insurance industry sees auto physical damage profitability recover, while casualty sectors grapple with increased medical inflation and social verdicts.

June 25

California

Colorado

Florida

Illinois

New Jersey

Federal Judge Rules Anthropic’s Book Use Fair but Piracy Still Faces Penalty

A San Francisco federal judge declares Anthropic’s AI book training fair use, yet rules storing millions of pirated copies illegal, setting stage for potential damages.

June 25

Legislation & Regulation

Litigation

Risk Management

Technology

California

Why Florida, Texas, and California Lead the Nation in Lightning Insurance Claims

Florida, Texas, and California consistently rank highest for lightning-related insurance claims due to storm frequency, surge damage, and wildfire-triggered losses.

June 24

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

Texas

Three Arrested in California Farmhouse Arson and $200K Insurance Fraud Scheme

Federal, state and local investigators allege three men—including a municipal vice mayor and a school board trustee—set a Northern California farmhouse ablaze and filed false insurance claims to net $200,000.

June 23

Fraud

Insurance Industry

Litigation

Property

California

Disney and Comcast Sue AI Startup Midjourney Over Use of Copyrighted Characters

Disney and Comcast allege AI image platform Midjourney infringed on iconic characters like Darth Vader and Shrek, seeking $150,000 per violation in federal court.

June 11

Insurance Industry

Legislation & Regulation

Litigation

Technology

California

Former Prosecutor Wins $3 Million Jury Award After Retaliation Allegations in California

A California jury awarded $3 million to former prosecutor Tracy Miller, who said she was forced from her role after defending colleagues reporting sexual harassment.

June 9

Insurance Industry

Legislation & Regulation

Liability

Litigation

California

Homeowners Take Legal Action Against USAA and AAA Insurers Over Los Angeles Wildfire Coverage Disputes

Lawsuits filed in Los Angeles County accuse USAA and AAA-affiliated insurers of underinsuring homes damaged in the January 7 wildfires, leaving policyholders unable to rebuild.

June 9

Catastrophe

Insurance Industry

Litigation

Property

California

Colorado Advances Wildfire Insurance with Predictive Tech Models

Starting July 2026, Colorado will let insurers use advanced risk models for wildfire coverage, aiming to price policies more accurately amid rising climate threats.

June 9

Catastrophe

Legislation & Regulation

Property

Technology

California

Colorado

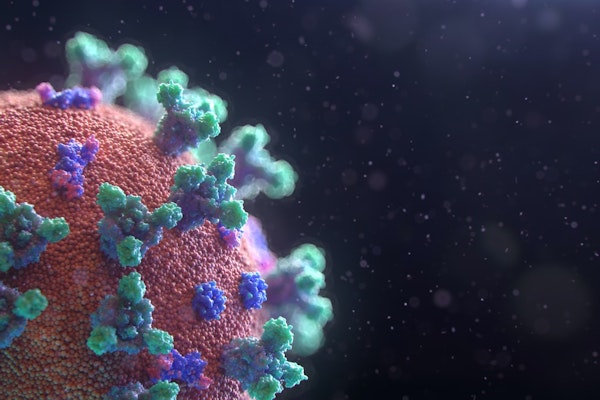

Long COVID Drives Most Workers’ Comp COVID Costs in California

A new study reveals that although Long COVID made up just 4.7% of California workers’ comp COVID claims, it accounted for nearly three-quarters of total claim costs from 2020 to 2022.

June 4

Insurance Industry

Life & Health

Risk Management

Workers' Compensation

California

Investigators Say Central California Carjacking Was Staged as Insurance Fraud

A reported van theft involving $60,000 in merchandise near Madera, California was revealed to be a staged event for insurance money, authorities say.

June 4

Auto

Fraud

Insurance Industry

Property

California