How to Manage Property Risk in 2025 with Smarter Valuation and Technology

As extreme weather events and insurance costs rise, property owners must adopt data-driven valuation, smart tech, and alternative coverage to remain insurable.

July 7

Catastrophe

Property

Risk Management

Technology

California

Florida

Auto Claims Profitability Improves Amid Rising Casualty Costs and Trade Issues

Insurance industry sees auto physical damage profitability recover, while casualty sectors grapple with increased medical inflation and social verdicts.

June 25

California

Colorado

Florida

Illinois

New Jersey

Why Florida, Texas, and California Lead the Nation in Lightning Insurance Claims

Florida, Texas, and California consistently rank highest for lightning-related insurance claims due to storm frequency, surge damage, and wildfire-triggered losses.

June 24

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

Texas

Insurance Leaders Highlight Litigation and AI Trends at JIF 2025 Forum

Insurance executives discuss navigating escalating litigation risks and embracing generative AI to enhance efficiency and rebuild consumer trust amid evolving uncertainties.

June 24

Insurance Industry

Legislation & Regulation

Litigation

Technology

Florida

Inside the Auto Glass Fraud Crisis

Auto glass scams are costing U.S. drivers billions, fueled by deceptive ‘free’ repairs and AOB schemes. Insurers and lawmakers are responding with pre-inspection programs and tougher penalties.

June 23

Auto

Fraud

Legislation & Regulation

Litigation

Florida

Kentucky

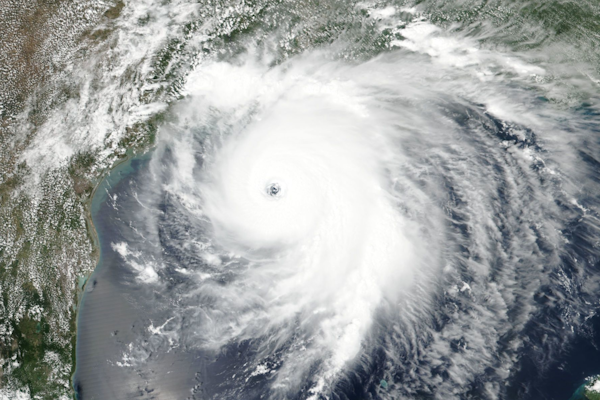

Colorado State University Predicts Above Normal 2025 Atlantic Hurricane Season

The 2025 Atlantic hurricane season is projected to be above-average with 17 named storms, nine hurricanes and four major hurricanes, increasing landfall risks along U.S. and Caribbean coasts.

June 19

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Texas

Florida Appeals Court Rebukes Citizens Property Insurance Over Roof Claim Denial

A Florida appeals court held that Citizens Property Insurance wrongly denied a roof damage claim and can’t invoke staged-payment rules until coverage is acknowledged, giving homeowners a second chance.

June 19

Insurance Industry

Legislation & Regulation

Litigation

Property

Florida

Updated Hurricane Loss Model Approved by Florida Commission

Florida’s hurricane model commission approves Karen Clark & Co.’s Version 5.0, featuring enhanced climate data, upgraded vulnerability functions, and new coverage modeling capabilities.

June 12

Catastrophe

Property

Risk Management

Technology

Florida

Natural Disasters and Legal Pressures Are Driving Up Homeowners Insurance Costs Nationwide

Homeowners insurance is becoming less affordable nationwide as natural disasters, legal system strain, and rising repair costs drive premiums higher, especially in disaster-prone states.

June 11

Catastrophe

Insurance Industry

Litigation

Property

Alaska

Florida

Louisiana

Maryland

Mississippi

How Georgia Can Tackle Rising Insurance Premiums and Loss Ratios

Georgia homeowners face surging premiums after back-to-back hurricanes. Lawmakers and insurers are exploring solutions to stabilize the market and protect consumers.

June 9

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Arkansas

Florida

Georgia

Louisiana

Florida Property Insurers Return to Profit in 2024 After Eight-Year Losing Streak

Following legislative reforms and shifting market dynamics, Florida’s personal property insurers posted underwriting profits in 2024 for the first time in nearly a decade.

June 4

Catastrophe

Insurance Industry

Legislation & Regulation

Property

Florida

Slightly Stronger 2025 Hurricane Season Expected Amid Climate Uncertainty

Forecasters anticipate a slightly above-average 2025 hurricane season in the Atlantic, though key uncertainties in ENSO and sea temperatures complicate predictions.

June 4

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Fishermen Face Rising Safety Risks as Federal Training Programs Lose Funding

Federal budget cuts threaten safety training programs for fishing, farming, and logging workers—among the nation’s most dangerous jobs—potentially leaving crews at greater risk.

June 2

Catastrophe

Education & Training

Legislation & Regulation

Risk Management

Alaska

Florida

Iowa

Maine

Massachusetts

Storm Surge Risk Threatens Billions in Coastal Property Value Across 20 States

Over 6.4 million homes in coastal U.S. states face moderate or greater storm surge risk, with $2.2 trillion in potential reconstruction costs, according to 2025 Cotality data.

June 2

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Connecticut

Delaware

District Of Columbia

Florida

Millions of Homes Unprotected as Climate-Driven Insurance Costs Soar

New research shows insurance protects against climate disasters, but millions of flood-prone homes remain uninsured as premiums climb beyond affordability.

May 20

Catastrophe

Legislation & Regulation

Property

Risk Management

California

Florida

Kentucky

Louisiana

New York