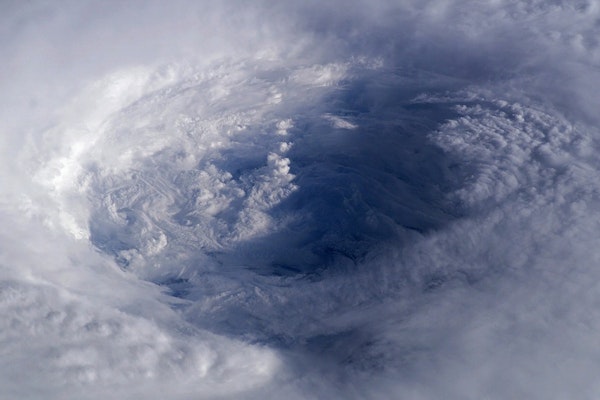

Gulf System Could Become Tropical Storm Dexter as Development Chances Rise

A low-pressure system moving from Florida into the Gulf may strengthen into Tropical Storm Dexter later this week, bringing heavy rain and flooding risks across the region.

July 15

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Mississippi

Texas

How a Warmer Climate Could Drive a 39% Surge in U.S. Hurricane Insurance Losses

A new scenario analysis reveals that insured U.S. hurricane losses could rise by nearly 40 percent under a 2 degrees Celsius warmer climate, with the greatest relative impacts along the East Coast.

July 15

Catastrophe

Insurance Industry

Property

Risk Management

How Rising Insurance Costs Are Leaving Millions Financially Strapped

Millions of Americans are paying more than ever for health, auto, home, and life insurance—stretching their budgets thin and fueling a growing crisis of insurance poverty.

July 15

Auto

Insurance Industry

Life & Health

Property

Ohio

Zuckerberg to Testify in $8 Billion Trial Alleging Facebook Misled Users and Shareholders

Mark Zuckerberg is set to testify in an $8 billion shareholder lawsuit alleging Facebook ignored a 2012 FTC order and misled users about privacy following the Cambridge Analytica scandal.

July 15

Insurance Industry

Litigation

Risk Management

Technology

Maryland Couple Sentenced for $20 Million Life Insurance Scam Involving Dozens of Fraudulent Policies

James and Maureen Wilson of Owings Mills, Maryland, received prison time and must repay over $18.7 million after orchestrating a massive life insurance fraud scheme.

July 10

Fraud

Insurance Industry

Life & Health

Litigation

Maryland

Why Coreless Architecture Is the Key to Scalable AI in Insurance

Insurers are adopting coreless architecture to scale AI, enhance digital servicing, and meet regulatory demands without discarding legacy core systems or disrupting operations.

July 10

Insurance Industry

Risk Management

Technology

Underwriting

Corporate Sustainability Strategies Gain Traction as Companies Eye Profitable Climate Resilience

Most companies now view sustainability as a value driver, with 88% recognizing profit potential despite high investment costs and climate-related operational challenges.

July 7

Insurance Industry

Property

Risk Management

Technology

Rhode Island Sets New Standards for Pet Insurance Policies and Sales Practices

Rhode Island’s new Pet Insurance Act introduces detailed consumer protections, requiring clear disclosures and training for producers starting January 1, 2026.

July 7

Education & Training

Insurance Industry

Legislation & Regulation

Life & Health

Rhode Island

Lululemon Sues Costco Over Lookalike Apparel Alleging Consumer Confusion

Lululemon claims Costco’s low-cost apparel mimics its trademarked designs, misleading customers and violating trade dress protections under U.S. trademark law.

July 7

Insurance Industry

Liability

Litigation

Risk Management

California

Louis Vuitton Reports Data Breach Affecting Customer Information

Louis Vuitton Korea disclosed a data breach from unauthorized access to its system, exposing select customer information while assuring no financial data was compromised.

July 7

Insurance Industry

Liability

Risk Management

Technology

AI Is Redefining Insurance from the Cloud Up

AI is no longer a back-office tool but a core force transforming how insurance is underwritten, processed, and scaled—with cloud, GenAI, and agentic systems leading the charge.

July 7

Education & Training

Insurance Industry

Technology

Underwriting

Louisiana Supreme Court Ruling Strengthens Contractor Defense in Road Signage Dispute

A Louisiana Supreme Court decision clarifies summary judgment standards, strengthening contractor defenses and reducing litigation exposure for insurers in similar cases.

July 7

Insurance Industry

Legislation & Regulation

Litigation

Property

Louisiana

U.S. Cyber Insurance Premiums Experience First-Ever Decline Amid Pricing Adjustments

U.S. cyber insurance premiums declined by 2.3% in 2024, driven by rate reductions even as claims frequency rose, highlighting evolving market risks and pricing trends.

July 2

Insurance Industry

Liability

Risk Management

Technology

Modernizing Insurance Claims Payment Infrastructure for Greater Efficiency and Trust

Research reveals that fragmented back-end financial systems hinder timely claims payments and increase risks, highlighting the need for integrated, real-time solutions.

June 30

Education & Training

Insurance Industry

Risk Management

Technology

Wildfires and Storms Drive Record Claim Severity in Early 2025 as Volume Hits Five-Year Low

Despite costly California wildfires and severe storms in Texas and the Midwest, property claim volume in Q1 2025 dropped to its lowest level in five years, Verisk reports.

June 24

Catastrophe

Insurance Industry

Property

Risk Management