How Water Leak Sensors Are Transforming Insurance Economics

Bolt’s successful integration of IoT water sensors with homeowner policies significantly reduces water damage claims, reshaping insurance profitability.

July 2

Property

Risk Management

Technology

Underwriting

Swiss Re Identifies Rising Risks Including Declining Trust, Excess Mortality, and Digital Liability

Swiss Re’s 2025 SONAR report examines emerging structural risks including trust erosion, mortality fluctuations, and digital liabilities reshaping insurance claims and coverage.

July 2

Fraud

Liability

Life & Health

Property

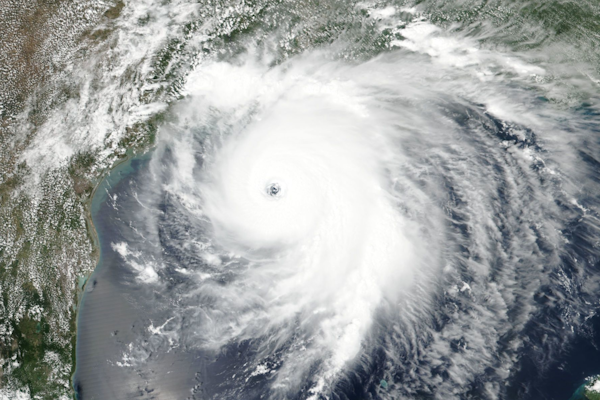

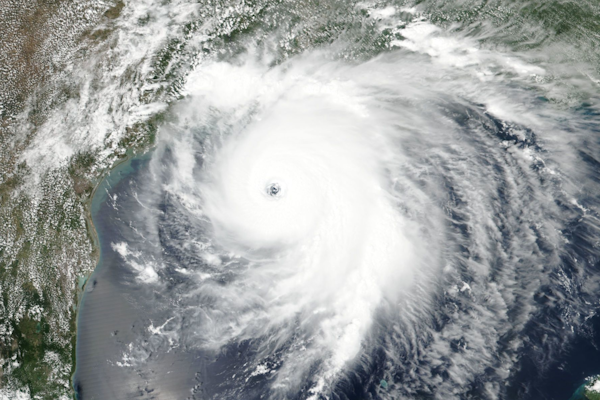

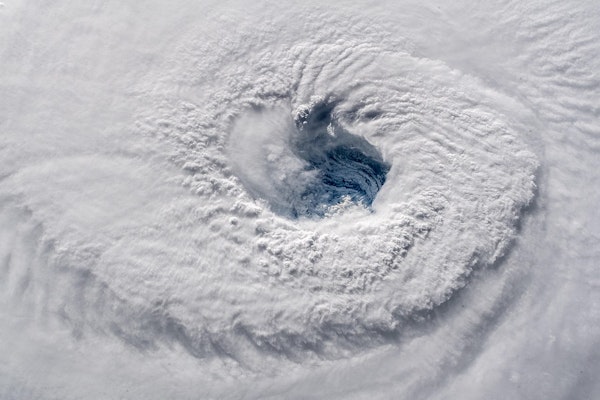

Loss of Military Satellite Data May Affect Hurricane Forecast Accuracy

Critical satellite data used for predicting rapid hurricane intensification will end June 30, potentially complicating forecasts during peak hurricane season.

June 30

Catastrophe

Property

Risk Management

Technology

How PFAS Influence Environmental Liability Risks in Construction Projects

Westfield Specialty’s Dennis Willette explores how PFAS contaminants shape environmental liability coverage in construction and why contractors need this insurance.

June 25

Legislation & Regulation

Liability

Property

Risk Management

Wildfires and Storms Drive Record Claim Severity in Early 2025 as Volume Hits Five-Year Low

Despite costly California wildfires and severe storms in Texas and the Midwest, property claim volume in Q1 2025 dropped to its lowest level in five years, Verisk reports.

June 24

Catastrophe

Insurance Industry

Property

Risk Management

Why Florida, Texas, and California Lead the Nation in Lightning Insurance Claims

Florida, Texas, and California consistently rank highest for lightning-related insurance claims due to storm frequency, surge damage, and wildfire-triggered losses.

June 24

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

Texas

Frustrating Digital Claims Processes Keep 20% of Consumers from Filing

A recent Insurity survey highlights the importance of blending digital convenience with human support to enhance policyholder satisfaction and claims experiences.

June 24

Auto

Insurance Industry

Property

Technology

Three Arrested in California Farmhouse Arson and $200K Insurance Fraud Scheme

Federal, state and local investigators allege three men—including a municipal vice mayor and a school board trustee—set a Northern California farmhouse ablaze and filed false insurance claims to net $200,000.

June 23

Fraud

Insurance Industry

Litigation

Property

California

Colorado State University Predicts Above Normal 2025 Atlantic Hurricane Season

The 2025 Atlantic hurricane season is projected to be above-average with 17 named storms, nine hurricanes and four major hurricanes, increasing landfall risks along U.S. and Caribbean coasts.

June 19

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Texas

Florida Appeals Court Rebukes Citizens Property Insurance Over Roof Claim Denial

A Florida appeals court held that Citizens Property Insurance wrongly denied a roof damage claim and can’t invoke staged-payment rules until coverage is acknowledged, giving homeowners a second chance.

June 19

Insurance Industry

Legislation & Regulation

Litigation

Property

Florida

Nail Salon Owner Arrested on Multiple Arson and Insurance Fraud Charges

Town of Newburgh authorities and federal agents allege a local salon owner deliberately set an August 2022 fire at her own shop to collect insurance payouts amid severe financial distress.

June 19

Fraud

Legislation & Regulation

Litigation

Property

New York

Claims Decline as Replacement Costs Skyrocket in Q1 2025

In Q1 2025, U.S. and Canadian property claims hit a five-year low even as average replacement costs surged 46 percent year-over-year, led by California wildfire losses and rising reconstruction expenses.

June 19

Catastrophe

Legislation & Regulation

Property

Risk Management

Hurricane Erick Pounds Mexican Coast with Fierce Winds and Flood Threat

Upgraded to ‘extremely dangerous’ Cat 4 before landfall, Erick made shore near Punta Maldonado with 125 mph winds, heavy rain and storm surge poised to trigger floods and mudslides.

June 19

Catastrophe

Insurance Industry

Property

Risk Management

Updated Hurricane Loss Model Approved by Florida Commission

Florida’s hurricane model commission approves Karen Clark & Co.’s Version 5.0, featuring enhanced climate data, upgraded vulnerability functions, and new coverage modeling capabilities.

June 12

Catastrophe

Property

Risk Management

Technology

Florida

Court Upholds Lloyd’s Denial in Diamond Loss Case Over Inactive Security System

A New York appellate court affirms Lloyd’s denial of coverage in a diamond loss claim, emphasizing that policyholders must maintain fully operational security systems.

June 12

Insurance Industry

Litigation

Property

Risk Management

New York