Natural Disasters and Legal Pressures Are Driving Up Homeowners Insurance Costs Nationwide

Homeowners insurance is becoming less affordable nationwide as natural disasters, legal system strain, and rising repair costs drive premiums higher, especially in disaster-prone states.

June 11

Catastrophe

Insurance Industry

Litigation

Property

Alaska

Florida

Louisiana

Maryland

Mississippi

Roof Resilience Is the Key to Lower Claims and Safer Homes

With 70-90% of storm-related claims involving roof damage, the FORTIFIED Roof standard offers a proven, cost-effective way to reduce risk and protect property.

June 4

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Mississippi

Oklahoma

Storm Surge Risk Threatens Billions in Coastal Property Value Across 20 States

Over 6.4 million homes in coastal U.S. states face moderate or greater storm surge risk, with $2.2 trillion in potential reconstruction costs, according to 2025 Cotality data.

June 2

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Connecticut

Delaware

District Of Columbia

Florida

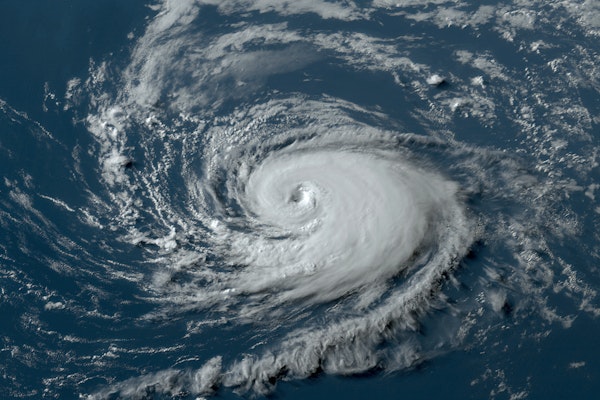

Neutral Pacific Waters Signal Potential Spike in Atlantic Hurricanes

With La Niña officially over and El Niño unlikely, the Atlantic may face an active hurricane season as neutral Pacific conditions remove key storm barriers.

April 21

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Florida

Louisiana

Mississippi

Texas

Why Climate Resilience Requires Both Parametric and Traditional Insurance Solutions

As billion-dollar weather disasters escalate, combining parametric and traditional insurance offers a faster, more adaptive recovery solution for policyholders across the U.S.

April 15

Catastrophe

Insurance Industry

Property

Technology

California

Florida

Louisiana

Mississippi

Historic Flooding Threat Intensifies Across Central US After Devastating Storms and Tornadoes

Following deadly tornadoes and widespread storm damage, central US states now face a rare high-risk flood event that could bring once-in-a-generation impacts.

April 4

Catastrophe

Property

Arkansas

Indiana

Kentucky

Mississippi

Missouri

Rising Insurance Costs and Severe Thunderstorms: How Convective Storms Are Reshaping Risk

Severe convective storms are a major driver of rising insurance costs, with hail, tornadoes, and strong winds causing billions in property damage. Understanding storm patterns can help insurers manage risk effectively.

February 24

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Florida

Georgia

Illinois

Indiana

Uninsured and Underinsured Drivers on the Rise in 2023, IRC Report Finds

A new Insurance Research Council (IRC) report reveals that over 33% of U.S. drivers in 2023 lacked sufficient auto insurance, marking a significant increase since 2017.

February 21

Auto

Insurance Industry

Legislation & Regulation

Risk Management

Colorado

District Of Columbia

Florida

Georgia

Kentucky

Year-End Tornadoes Spark Surge in Insurance Claims Across Southern States

Severe storms from December 26–29, 2024, caused extensive tornado damage across 10 Southern states, generating over 2,700 insurance claims and highlighting a rising trend in extreme weather events.

January 6

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Mississippi

North Carolina

South Carolina

Texas

Rising Home Insurance Nonrenewals Reshape Housing Market Across the U.S.

As climate-driven disasters increase, nonrenewed home insurance policies are surging nationwide, impacting property values, mortgages, and economic stability in vulnerable communities.

December 30, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

California

Colorado

Connecticut

Florida

Mississippi Restaurant Fined $1.5M for Seafood Mislabeling Scheme

A Gulf Coast restaurant and co-owner face penalties after years of selling mislabeled imported seafood as premium local fish, defrauding customers and the seafood industry.

November 20, 2024

Fraud

Legislation & Regulation

Liability

Risk Management

Mississippi

Louisiana’s Auto Insurance Affordability Challenges Persist in 2022

Despite rising incomes, Louisiana remains the least affordable state for personal auto coverage across the South and U.S., with premiums nearly 40% above the national average.

October 15, 2024

Auto

Legislation & Regulation

Litigation

Risk Management

Florida

Louisiana

Mississippi

North Carolina

Dockworkers Reach Tentative Deal, Strike Suspended Until January

U.S. dockworkers have suspended their strike after reaching a tentative agreement with terminal operators, securing a wage increase and agreeing to continue negotiations in January.

October 4, 2024

Legislation & Regulation

Litigation

Risk Management

Alabama

Florida

Georgia

Louisiana

Maryland

Key Restaurant Insurance Claims Insights to Help Adjusters Minimize Payouts

Understand the most frequent and costly insurance claims in the restaurant industry, from equipment breakdown to employee injury, and how claims adjusters can help mitigate risks.

September 30, 2024

Liability

Property

Risk Management

Workers' Compensation

California

Florida

Michigan

Mississippi

New Jersey

Hurricane Threat Looms for Gulf Coast as Atlantic Storm Intensifies

A developing Atlantic storm poses a significant hurricane risk to the US Gulf Coast, stretching from Mississippi to Florida. Forecasters predict rapid intensification as it moves north through warm Gulf waters, threatening major landfall.

September 23, 2024

Catastrophe

Litigation

Property

Risk Management

Florida

Mississippi