Columbia University Data Breach Impacts 870,000 People With Personal, Academic, and Financial Details Exposed

Columbia University reports a cyberattack compromising personal, academic, and financial data of nearly 870,000 individuals, with investigations and notifications ongoing.

August 11

Education & Training

Insurance Industry

Risk Management

Technology

California

Maine

Fishermen Face Rising Safety Risks as Federal Training Programs Lose Funding

Federal budget cuts threaten safety training programs for fishing, farming, and logging workers—among the nation’s most dangerous jobs—potentially leaving crews at greater risk.

June 2

Catastrophe

Education & Training

Legislation & Regulation

Risk Management

Alaska

Florida

Iowa

Maine

Massachusetts

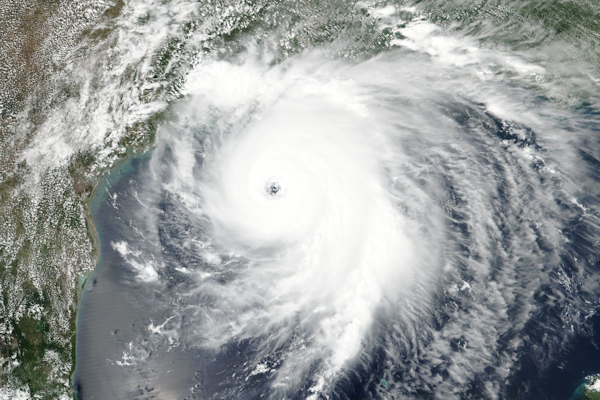

Storm Surge Risk Threatens Billions in Coastal Property Value Across 20 States

Over 6.4 million homes in coastal U.S. states face moderate or greater storm surge risk, with $2.2 trillion in potential reconstruction costs, according to 2025 Cotality data.

June 2

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Connecticut

Delaware

District Of Columbia

Florida

Weather Balloon Cuts Threaten Forecast Accuracy Amid Severe Season

National Weather Service balloon launch reductions, blamed on Department of Government Efficiency (DOGE) staff cuts, threaten forecast accuracy during severe weather season, raising concerns for claims adjusters.

March 25

Catastrophe

Insurance Industry

Legislation & Regulation

Risk Management

Technology

Colorado

Maine

Nebraska

New York

South Dakota

Maine Stands Out as Home Insurance Rates Hold Steady Amid National Spikes

While home insurance premiums rise across the U.S., Maine has maintained stability, experiencing a rate decrease in 2024. Geography and low disaster risk contribute to its resilience.

February 25

Insurance Industry

Legislation & Regulation

Property

Risk Management

Maine

Massachusetts

New Hampshire

Vermont

Uninsured and Underinsured Drivers on the Rise in 2023, IRC Report Finds

A new Insurance Research Council (IRC) report reveals that over 33% of U.S. drivers in 2023 lacked sufficient auto insurance, marking a significant increase since 2017.

February 21

Auto

Insurance Industry

Legislation & Regulation

Risk Management

Colorado

District Of Columbia

Florida

Georgia

Kentucky

Saint Vincent’s to Pay $29M Over Alleged False Claims Act Violations

Saint Vincent’s Catholic Medical Centers of New York will pay $29 million to settle allegations of False Claims Act violations related to overpayments from the Department of Defense for healthcare services provided to retired military members and their families.

February 17

Fraud

Insurance Industry

Legislation & Regulation

Litigation

Maine

New York

Massachusetts Wildfires Spread as Drought and High Winds Intensify Risks

Ongoing drought and high winds have sparked severe brush fires across Massachusetts, with over 1,500 acres already burned this season. Officials urge caution as red flag warnings remain in place.

November 14, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Maine

Massachusetts

New Hampshire

NOAA Proposes $575 Million for Coastal Climate Resilience

NOAA recommends $575 million in funding for 19 projects to enhance coastal climate resilience under the Investing in America agenda.

July 31, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Alaska

California

Delaware

Hawaii

Louisiana

Homeowners Face 21% Insurance Premium Increase, Climate Change Cited as Major Factor

Homeowners insurance premiums surged by 21% from May 2022 to May 2023, largely due to severe weather events driven by climate change, leaving many homeowners with limited options.

July 29, 2024

Catastrophe

Insurance Industry

Legislation & Regulation

Property

California

Colorado

Florida

Idaho

Louisiana

Rite Aid Data Breach Impacts 2.2 Million Customers

Rite Aid, the third-largest US drug store chain, revealed that a data breach exposed sensitive information of over 2.2 million customers, including names, addresses, birth dates, and driver’s license numbers.

July 16, 2024

Insurance Industry

Litigation

Risk Management

Technology

Maine

Massachusetts

Oregon

Vermont

New Study Uncovers State Variations in Workers’ Compensation for First Responders’ Mental Health

Recent research from the FIRST Center highlights significant differences in state workers’ compensation laws for first responders with mental health conditions, emphasizing the need for uniform presumption laws.

July 16, 2024

Legislation & Regulation

Life & Health

Risk Management

Workers' Compensation

Alaska

Arizona

California

Colorado

Connecticut

CoreLogic’s 2024 Report Analyzes Hurricane Risk for U.S. Gulf and Atlantic States

CoreLogic’s 2024 Hurricane Risk Report details the potential impact of hurricanes on U.S. Gulf and Atlantic states, emphasizing the need for updated risk assessments to ensure effective preparation and mitigation.

May 30, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Maine

New Jersey

New York

Pennsylvania

Climate Change Boosts Extreme Weather, Increasing U.S. Flood Risks

Climate change intensifies extreme precipitation, escalating flood risks across the U.S. with significant increases in the Northeast and Midwest.

May 6, 2024

Catastrophe

Property

Risk Management

Alabama

Alaska

Georgia

Hawaii

Kentucky

Homeowners Brace for Further Hikes Amid Climate and Market Pressures

As homeowners grapple with a 19.8% spike in insurance rates, projections show a relentless 6% increase into 2024, heavily influenced by climate change and severe weather patterns.

April 1, 2024

Catastrophe

Legislation & Regulation

Property

Connecticut

Florida

Illinois

Louisiana

Maine