Roof Resilience Is the Key to Lower Claims and Safer Homes

With 70-90% of storm-related claims involving roof damage, the FORTIFIED Roof standard offers a proven, cost-effective way to reduce risk and protect property.

June 4

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Mississippi

Oklahoma

Storm Surge Risk Threatens Billions in Coastal Property Value Across 20 States

Over 6.4 million homes in coastal U.S. states face moderate or greater storm surge risk, with $2.2 trillion in potential reconstruction costs, according to 2025 Cotality data.

June 2

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Connecticut

Delaware

District Of Columbia

Florida

How P&C Carriers Can Successfully Modernize Core Systems in Today’s Digital Environment

Modernization of core systems is crucial for P&C insurers to reduce costs, improve customer experience, and keep pace with digital innovation—but success demands a strategic, business-led approach.

June 2

Insurance Industry

Property

Risk Management

Technology

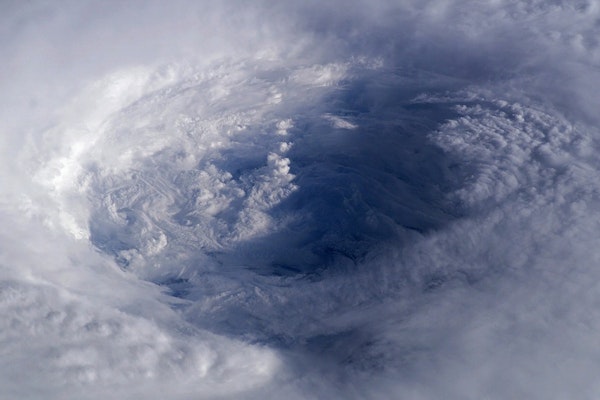

Early-Season Hurricanes: Where June Storms Typically Form and Why Activity Has Increased

Although June is typically a quiet start to Atlantic hurricane season, recent years show a rise in early storm activity, especially near the Gulf and Southeast U.S. coasts.

May 28

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Louisiana

Texas

Frustrating Claims Processes Drive Policyholders to Avoid Filing and Consider Switching Insurers

A new survey finds 22% of consumers skip filing claims due to complex processes, while 64% would switch insurers for a smoother digital experience.

May 28

Insurance Industry

Property

Risk Management

Technology

How AI Can Help Insurers Detect and Cut Down on Fraud

With advanced analytics and pattern recognition, AI could help P&C insurers save up to $160 billion annually by detecting both soft and hard fraud more effectively.

May 28

Fraud

Property

Risk Management

Technology

Texas Faces Critical Flood Insurance Gap as Risk Rises Statewide

A new report by Neptune Flood highlights Texas’s escalating flood risk and the urgent need to close the state’s massive and growing insurance coverage gap.

May 21

Catastrophe

Insurance Industry

Legislation & Regulation

Property

Texas

Warner Robins Insurance Agent Charged with Bank Fraud over Misuse of $220K in Client Funds

A former Alfa Insurance agent in Warner Robins faces federal charges for allegedly directing a client to withdraw $220K, which he used to pay others’ insurance premiums.

May 20

Fraud

Insurance Industry

Legislation & Regulation

Property

Georgia

Millions of Homes Unprotected as Climate-Driven Insurance Costs Soar

New research shows insurance protects against climate disasters, but millions of flood-prone homes remain uninsured as premiums climb beyond affordability.

May 20

Catastrophe

Legislation & Regulation

Property

Risk Management

California

Florida

Kentucky

Louisiana

New York

Climate Change Drives Rising Home Insurance Costs and Coverage Gaps

As climate disasters increase, insurers are hiking premiums, reducing coverage, or exiting markets—leaving homeowners, states, and federal programs to fill the gap.

May 20

Catastrophe

Legislation & Regulation

Property

Risk Management

California

Florida

Maryland

EPA Plans to Weaken Drinking Water Limits on Emerging PFAS Chemicals

The EPA will maintain strict limits for two common ‘forever chemicals’ but plans to roll back standards for others, citing legal challenges and utility concerns.

May 19

Catastrophe

Legislation & Regulation

Property

Risk Management

New York

North Carolina

Insurers Scramble for Disaster Data After NOAA Halts Updates

With NOAA’s disaster data program discontinued after 2024, insurance companies face major challenges in modeling risk, pricing policies, and ensuring climate resilience.

May 13

Catastrophe

Insurance Industry

Property

Risk Management

California

How Property and Casualty Insurers Can Combat Fraud with AI-Driven Multimodal Technology

AI-powered multimodal tech is helping property and casualty insurers detect fraud more accurately across the claims cycle, potentially saving billions and lowering premium costs.

May 13

Fraud

Insurance Industry

Property

Technology

Escrow Officer Sentenced to Prison for Orchestrating $350K Title Fraud Scheme in Texas

A McAllen, Texas escrow officer was sentenced to 24 months in prison for wire fraud after falsifying real estate documents and defrauding lenders and buyers of over $350,000.

May 13

Fraud

Insurance Industry

Litigation

Property

Texas

Florida Appeals Court Backs Insurer’s Right to Enforce Repair Option in Homeowner Dispute

A recent Florida appellate ruling reinforces insurers’ authority to enforce managed repair clauses, highlighting the importance of policy clarity in property claim disputes.

May 12

Insurance Industry

Legislation & Regulation

Litigation

Property

Florida