Cyber Insurance Market Expands as AI and Financial Fraud Reshape Risk Landscape

With premium drops, rising capacity, and AI-driven threats, the cyber insurance market in 2025 presents both opportunities and volatility for adjusters and carriers alike.

August 14

Education & Training

Insurance Industry

Risk Management

Technology

Nonprofit Revives NOAA Billion-Dollar Disaster Data to Support Risk Modeling

Climate Central will take over the halted NOAA database of billion-dollar disasters, expanding its scope to support insurers, researchers, and public safety planning.

August 14

Catastrophe

Legislation & Regulation

Property

Risk Management

Why Outdated Payment Systems Are Holding P&C Insurers Back

Outdated and siloed payment systems are costing P&C insurers in efficiency, customer trust, and compliance—modernizing them is now a strategic necessity.

August 14

Insurance Industry

Property

Risk Management

Technology

Record-Breaking Insured Losses in 2025 Highlight Growing Impact of U.S. Wildfires and Storms

The first half of 2025 brought $84 billion in insured catastrophe losses, driven by U.S. wildfires and severe convective storms, making it the costliest H1 since 2011.

August 14

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

New Jersey

New York

North Carolina

Aon Sued Over Alleged Fraud in Vesttoo Credit Insurance Dealings

A creditor trust for bankrupt AI firm Vesttoo has sued Aon, claiming the broker committed fraud while promoting credit insurance linked to a failed funding scheme.

August 14

Fraud

Insurance Industry

Litigation

Risk Management

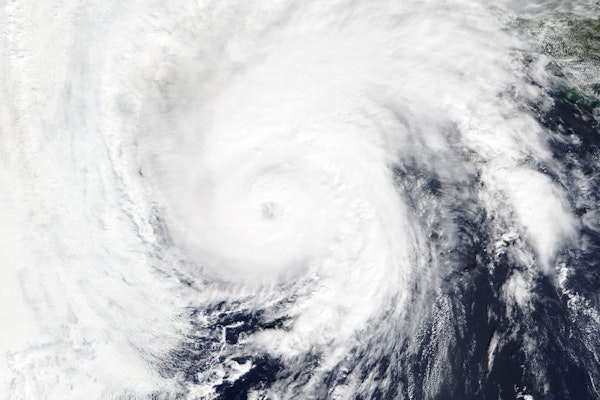

Tropical Storm Erin on Track to Become Hurricane with Impacts Likely in Northern Caribbean

Tropical Storm Erin may strengthen into a hurricane by Friday, with potential impacts including high surf and rip currents in the northern Leeward Islands, Virgin Islands, and Puerto Rico.

August 14

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Columbia University Data Breach Impacts 870,000 People With Personal, Academic, and Financial Details Exposed

Columbia University reports a cyberattack compromising personal, academic, and financial data of nearly 870,000 individuals, with investigations and notifications ongoing.

August 11

Education & Training

Insurance Industry

Risk Management

Technology

California

Maine

NOAA Maintains Above-Normal Hurricane Season Outlook With Updated 2025 Forecast

NOAA’s updated 2025 Atlantic hurricane forecast still calls for above-normal activity, with 13-18 named storms expected and up to five major hurricanes possible.

August 8

Catastrophe

Legislation & Regulation

Property

Risk Management

Why Maryland Has the Highest Car Insurance Rates in the Nation

Maryland drivers pay the highest auto insurance rates in the U.S., with premiums driven by urban congestion, repair costs, extreme weather, and frequent claims.

August 7

Auto

Property

Risk Management

Technology

Maryland

Mastering Property Claim Investigations with Subject Matter Experts

A guide to working effectively with subject matter experts in property claims—from basic investigations to litigation-ready forensic reports and cost analyses.

August 7

Education & Training

Litigation

Property

Risk Management

Breaking Down Data Barriers to Strengthen AI Risk Management

Insurers, tech companies, and businesses must securely share data and align strategies to manage AI risks, prevent losses, and support responsible innovation.

August 7

Insurance Industry

Liability

Risk Management

Technology

Fraud Strikes Over One-Third of Americans Impacted by Natural Disasters, AICPA Survey Reveals

A new AICPA survey finds 37% of Americans impacted by natural disasters experienced fraud, with identity theft and contractor scams among the top reported schemes.

August 5

Catastrophe

Fraud

Insurance Industry

Risk Management

California Defense Firm and Investor Settle Cybersecurity Violations for $1.75 Million

Aero Turbine and Gallant Capital will pay $1.75 million to resolve False Claims Act allegations tied to cybersecurity failures in an Air Force contract from 2018 to 2020.

August 5

Insurance Industry

Litigation

Risk Management

Technology

California

Insurers Race to Understand AI Risks as Automation Reshapes Liability

As AI transforms industries and increases systemic risk, insurers are racing to develop policies for algorithmic failures, liability questions, and regulatory compliance.

August 5

Insurance Industry

Liability

Risk Management

Technology

What Golden Retrievers Are Teaching Us About Wildfire Smoke Exposure

A new study on golden retrievers reveals how wildfire smoke impacts pet and human health, with implications for insurance costs, coverage, and long-term risk management.

August 5

Insurance Industry

Life & Health

Property

Risk Management

California

Colorado

Oregon