Frustrating Digital Claims Processes Keep 20% of Consumers from Filing

A recent Insurity survey highlights the importance of blending digital convenience with human support to enhance policyholder satisfaction and claims experiences.

June 24

Auto

Insurance Industry

Property

Technology

Inside the Auto Glass Fraud Crisis

Auto glass scams are costing U.S. drivers billions, fueled by deceptive ‘free’ repairs and AOB schemes. Insurers and lawmakers are responding with pre-inspection programs and tougher penalties.

June 23

Auto

Fraud

Legislation & Regulation

Litigation

Florida

Kentucky

Three Arrested in California Farmhouse Arson and $200K Insurance Fraud Scheme

Federal, state and local investigators allege three men—including a municipal vice mayor and a school board trustee—set a Northern California farmhouse ablaze and filed false insurance claims to net $200,000.

June 23

Fraud

Insurance Industry

Litigation

Property

California

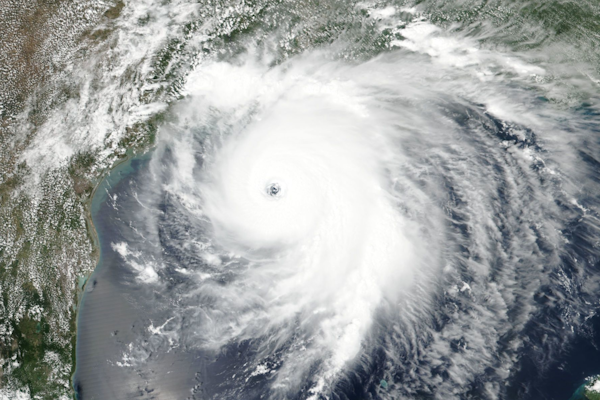

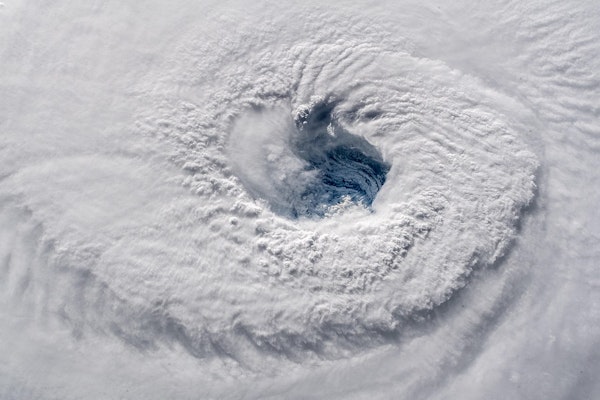

Colorado State University Predicts Above Normal 2025 Atlantic Hurricane Season

The 2025 Atlantic hurricane season is projected to be above-average with 17 named storms, nine hurricanes and four major hurricanes, increasing landfall risks along U.S. and Caribbean coasts.

June 19

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Texas

Florida Appeals Court Rebukes Citizens Property Insurance Over Roof Claim Denial

A Florida appeals court held that Citizens Property Insurance wrongly denied a roof damage claim and can’t invoke staged-payment rules until coverage is acknowledged, giving homeowners a second chance.

June 19

Insurance Industry

Legislation & Regulation

Litigation

Property

Florida

Nail Salon Owner Arrested on Multiple Arson and Insurance Fraud Charges

Town of Newburgh authorities and federal agents allege a local salon owner deliberately set an August 2022 fire at her own shop to collect insurance payouts amid severe financial distress.

June 19

Fraud

Legislation & Regulation

Litigation

Property

New York

Revolutionizing Catastrophe Modeling with AI for Insurers

Insurers can modernize CAT modeling by integrating AI-driven data capture, cleansing, enrichment, and analysis to deliver dynamic, real-time risk assessments that enhance underwriting and portfolio decisions.

June 19

Catastrophe

Insurance Industry

Risk Management

Technology

Claims Decline as Replacement Costs Skyrocket in Q1 2025

In Q1 2025, U.S. and Canadian property claims hit a five-year low even as average replacement costs surged 46 percent year-over-year, led by California wildfire losses and rising reconstruction expenses.

June 19

Catastrophe

Legislation & Regulation

Property

Risk Management

Insurance Industry Pushes Back on Federal AI Regulation Moratorium

The PIA, NAIC, AITC and NCOIL all warn that a proposed 10-year federal ban on state AI regulation would undermine consumer protections, stifle innovation and disrupt insurance markets.

June 19

Insurance Industry

Legislation & Regulation

Risk Management

Technology

Unlocking Underwriting Efficiency with Agentic AI Solutions

Agentic AI empowers carriers to tackle operational underwriting bottlenecks—streamlining risk analysis, fraud detection, and workflow automation to boost capacity in today’s talent-scarce market.

June 19

Insurance Industry

Risk Management

Technology

Underwriting

Court Sides with Asbestos Victim’s Heirs Over Insurance Time-Bar Dispute

The Louisiana 4th Circuit held that ambiguous policy definitions and lack of proof bar insurers from enforcing a 36-month exclusion on a mesothelioma wrongful death claim.

June 19

Insurance Industry

Liability

Litigation

Workers' Compensation

Louisiana

Finding Common Ground in Professional Liability Defense Strategies

Early collaboration between carriers, insureds, and panel counsel in professional liability claims reduces defense costs, preserves policy limits, and strengthens renewal prospects through faster settlements.

June 19

Insurance Industry

Litigation

Risk Management

Underwriting

Louisiana

New York

Texas

Hurricane Erick Pounds Mexican Coast with Fierce Winds and Flood Threat

Upgraded to ‘extremely dangerous’ Cat 4 before landfall, Erick made shore near Punta Maldonado with 125 mph winds, heavy rain and storm surge poised to trigger floods and mudslides.

June 19

Catastrophe

Insurance Industry

Property

Risk Management

Washington Post Cyberattack Targets Journalists Covering China and National Security

A targeted cyberattack compromised Microsoft accounts of Washington Post reporters covering China and national security, prompting a sweeping internal investigation.

June 16

Insurance Industry

Litigation

Risk Management

Technology

Purdue Pharma Gains Widespread State Backing for $7.4 Billion Opioid Crisis Settlement

Fifty-five states and territories back Purdue Pharma’s $7.4B opioid settlement plan, aiming to resolve lawsuits and distribute funds to governments, tribes, and individuals.

June 16

Insurance Industry

Legislation & Regulation

Life & Health

Litigation

New York

Oklahoma