New Guide Explains How Legal System Abuse Raises Insurance Costs and Threatens Coverage Availability

A new consumer guide from Triple-I and Munich Re US reveals how legal system abuse inflates claim costs, drives premium increases, and limits insurance accessibility.

June 16

Insurance Industry

Liability

Litigation

Risk Management

States Move to Halt 23andMe Sale Over Privacy Concerns About Genetic Data

Twenty-seven states and D.C. filed suit to block the sale of genetic and medical data in 23andMe’s bankruptcy, citing lack of informed customer consent.

June 12

Legislation & Regulation

Life & Health

Risk Management

Technology

Utility and AI Apps Dominate as Distracted Driving Habits Shift in 2024

CMT’s 2024 report reveals a shift in distracted driving habits, with fewer drivers using phones but a surge in utility and AI app usage behind the wheel.

June 12

Auto

Insurance Industry

Risk Management

Technology

Massachusetts

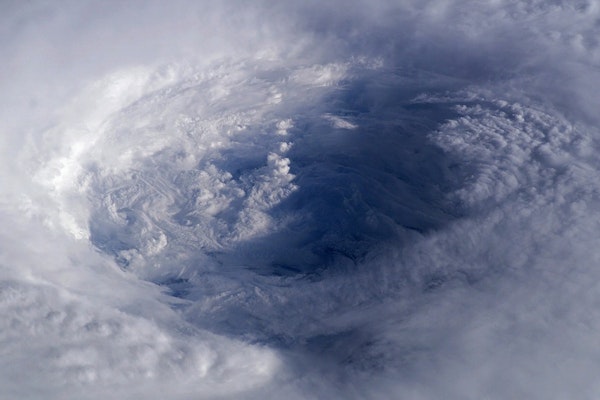

Google Partners with National Hurricane Center for AI-powered Tropical Cyclone Forecasts

Google is working with the National Hurricane Center to evaluate a new AI model that could enhance tropical storm predictions up to 15 days in advance.

June 12

Catastrophe

Legislation & Regulation

Risk Management

Technology

Updated Hurricane Loss Model Approved by Florida Commission

Florida’s hurricane model commission approves Karen Clark & Co.’s Version 5.0, featuring enhanced climate data, upgraded vulnerability functions, and new coverage modeling capabilities.

June 12

Catastrophe

Property

Risk Management

Technology

Florida

Court Upholds Lloyd’s Denial in Diamond Loss Case Over Inactive Security System

A New York appellate court affirms Lloyd’s denial of coverage in a diamond loss claim, emphasizing that policyholders must maintain fully operational security systems.

June 12

Insurance Industry

Litigation

Property

Risk Management

New York

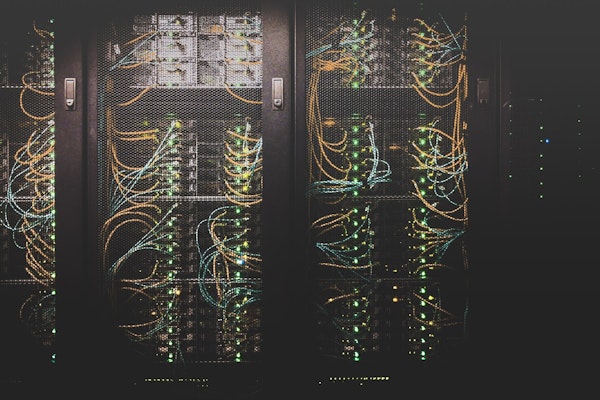

AI in Claims Management Is Advancing with Better Data and Human Insight

Industry leaders say AI’s real value in claims management lies in improving data quality and enhancing adjuster decision-making—not replacing human expertise.

June 12

Education & Training

Insurance Industry

Technology

Personal Auto Insurance Sees Strongest Underwriting Year Since COVID Disruptions

The U.S. personal auto insurance sector posted a 95.3 combined ratio in 2024—its best underwriting result since COVID—driven by rate increases and improved loss ratios.

June 12

Auto

Insurance Industry

Legislation & Regulation

Litigation

AI Agents Now Handle Insurance Policies from Quote to Claim with Sure’s New Protocol

Sure introduces its Model Context Protocol, enabling AI agents to autonomously quote, bind, and service insurance policies with integrated compliance and multi-carrier support.

June 11

Auto

Insurance Industry

Property

Technology

Texas

Disney and Comcast Sue AI Startup Midjourney Over Use of Copyrighted Characters

Disney and Comcast allege AI image platform Midjourney infringed on iconic characters like Darth Vader and Shrek, seeking $150,000 per violation in federal court.

June 11

Insurance Industry

Legislation & Regulation

Litigation

Technology

California

Natural Disasters and Legal Pressures Are Driving Up Homeowners Insurance Costs Nationwide

Homeowners insurance is becoming less affordable nationwide as natural disasters, legal system strain, and rising repair costs drive premiums higher, especially in disaster-prone states.

June 11

Catastrophe

Insurance Industry

Litigation

Property

Alaska

Florida

Louisiana

Maryland

Mississippi

How the Insurance Industry Is Preparing for a Fierce 2025 Hurricane Season

After a season of compounding storms and inland flooding in 2024, the insurance industry is refining its storm strategies and readiness plans for a potentially active 2025.

June 11

Catastrophe

Education & Training

Insurance Industry

Property

Cyberattack Disrupts Operations at Whole Foods Supplier United Natural Foods

United Natural Foods, a key supplier for Whole Foods, took systems offline after unauthorized network activity, causing temporary disruptions in order fulfillment and distribution.

June 10

Insurance Industry

Property

Risk Management

Technology

Rhode Island

AI Acceleration Signals Big Opportunities for Insurers as Adoption Surges

Mary Meeker’s new 340-page AI report reveals explosive growth, accelerating adoption, and decreasing costs—pointing to major advantages for insurers leveraging the technology.

June 10

Fraud

Insurance Industry

Risk Management

Technology

Million-Dollar Health Claims Spike as Employers Struggle with Soaring Costs

A 29% rise in million-dollar medical claims over the past year is squeezing self-funded employers, with cancer remaining the top cost driver, Sun Life’s data reveals.

June 10

Insurance Industry

Life & Health

Risk Management

Workers' Compensation